A global grain crisis 🌾

a perfect storm in the wheat market could portend something much bigger

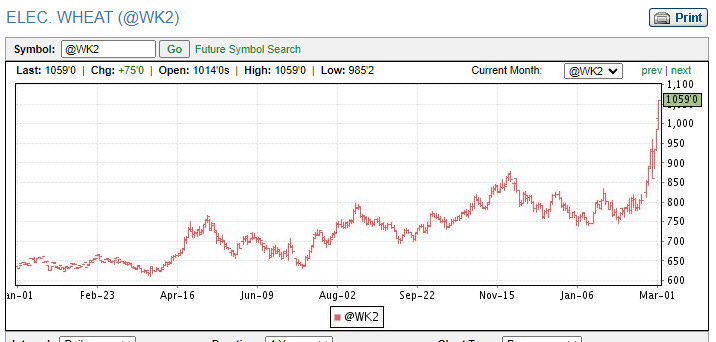

Ukraine, Russia, and Belarus produce 25% of global wheat. This supply is now off the market and as a result global wheat prices are spiking - they are up 50% since the end of February. But this is just the beginning of the story.

Heavy rainfall last year delayed the planting of more than 30% of China’s wheat. Production of the crop is down by 20% this year. Other major wheat exporter (EU, US, Canada) stocks have fallen to a nine year low due to drought.

Ongoing price inflation presents the risk of countries locking down their supplies of commodities and agricultural inputs. There are already restrictions on fertilizer exports from Russia and China to keep prices lower for local farmers, which has only exacerbated global price increases.

By the end of the 2022 season, China will hold the world’s largest stockpile of wheat: 47% of global supply. If they decide to reduce or cut off exports, it will have a massive impact on global prices.

Layered on top of this is a diversion away from growing wheat into oil crops for renewable diesel, especially in the EU and US. Oil companies desperate to pivot into lower carbon industries, are plowing billions of dollars into biodiesel projects. Unfortunately, there is limited evidence to show that renewable diesel is a viable climate solution, and this is putting further pressure on the food supply.

We can expect to see much higher prices for flour, bread, and pasta, as well as ongoing shortages of the wheat based products we love. But the bigger issue arises in places in the developing world that rely on wheat imports to provide a caloric baseline, especially the Middle East and North Africa. Food shortages in these regions could set us up for significant political instability.

I’m not sure how this scenario plays out. Resisting protectionism and allowing for clear translation from commodity price to farmers is important, so they have the flexibility to meet demand. A trade war with China would be devastating. The question of “food vs. fuel” will rear its head again, and hopefully there will be a correction in the renewable diesel industry.

But most of all we need to invest in boosting domestic yield and supporting our crucial agriculture infrastructure, to build greater resilience in our food supply. We have never experienced a serious food crisis in the US, but one may be brewing.

this changed my perspective on wheat. thank you so much.